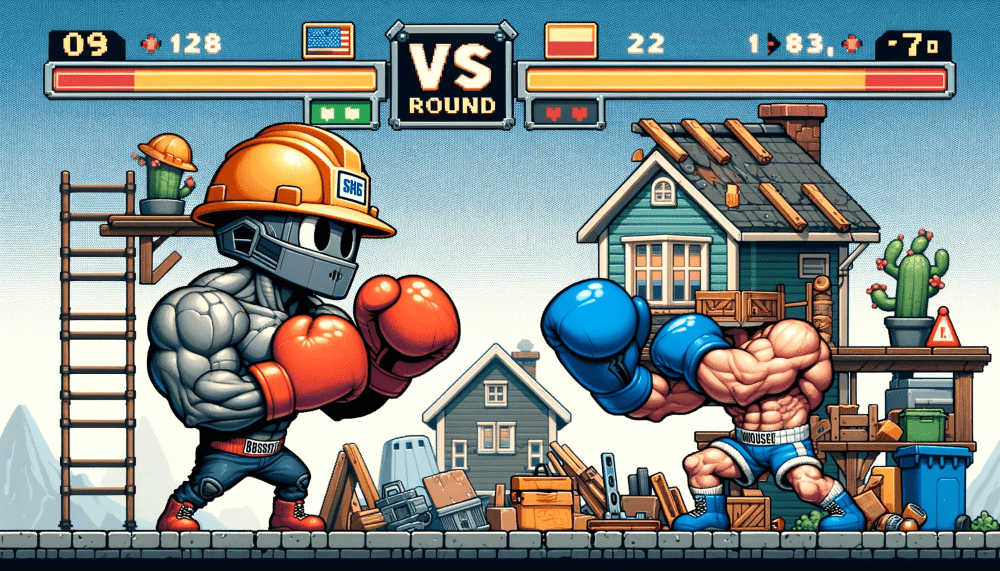

Construction Loans Versus Home Loans (Mortgage):

Navigating Your Path to Homeownership

Introduction

Embarking on the journey of building or buying a home is a landmark decision in one’s life. It represents a place of comfort, a haven for family, and an investment in the future. Central to this process is understanding the financial tools available to turn the dream of homeownership into reality. Two primary financing options are construction loans and home mortgages. Each serves a unique purpose, and choosing the right one can save time, money, and stress. In this comprehensive guide, we’ll explore the intricacies of construction loans versus home loans, helping you make an informed decision tailored to your homeownership aspirations.

Understanding Construction Loans

The Basics

A construction loan is a short-term, higher-interest loan that provides the funds necessary to build a home from the ground up. Unlike traditional home loans, construction loans cover the costs of land, labor, materials, and permits. They are typically disbursed in stages as construction milestones are reached, and inspections confirm progress.

How They Work

- Application and Approval: Prospective borrowers must present detailed building plans, a realistic budget, and a timeline for construction.

- Disbursement of Funds: Instead of a lump sum, funds are released in intervals, often directly to contractors.

- Interest-Only Payments: During construction, borrowers typically pay only interest on the drawn amount.

- Conversion to Permanent Mortgage: Upon completion, the loan often converts to a standard mortgage, or the borrower must seek new financing.

Deciphering Home Loans (Mortgages)

The Concept

A home loan, or mortgage, is a long-term financial product used to purchase an existing home. The borrower repays the loan amount, along with interest, over an agreed period, typically 15 to 30 years.

Features

- Fixed or Variable Interest Rates: Mortgages can have fixed interest rates, which remain constant, or variable rates, which can fluctuate.

- Down Payment: A percentage of the home’s purchase price paid upfront.

- Equity Building: With each payment, the borrower’s equity in the home increases.

Comparing Construction Loans and Home Loans

| Feature | Construction Loan | Home Loan |

|---|---|---|

| Purpose | To finance the building of a home | To finance the purchase of an existing home |

| Interest Rates | Typically higher | Generally lower |

| Loan Term | Short-term (1 year) | Long-term (15-30 years) |

| Disbursement | In stages | Lump sum |

| Payments | Interest-only during construction | Principal plus interest |

Choosing the Right Option:

For Building a New Home

If you are planning to build a custom home, a construction loan is likely your best bet. It caters to the unique funding needs of a construction project and seamlessly transitions into a permanent mortgage.

For Buying an Existing Home

When purchasing an existing property, a traditional home loan is the appropriate choice. It offers the simplicity of a single loan for the entire cost of the home, often with lower interest rates.

Considerations and Tips

- Creditworthiness: Both loans require good credit scores, but construction loans typically have stricter standards due to their higher risk.

- Down Payment: Construction loans may require a larger down payment.

- Interest Rates: Shop around for the best rates and terms.

- Builder’s Reputation: When seeking a construction loan, choose reputable builders to satisfy lenders.

- Future Planning: Consider the end mortgage when applying for a construction loan to ensure affordability.

Conclusion

Whether you’re building from scratch or buying an existing home, understanding the differences between construction loans and home loans is crucial. Evaluate your financial situation, consult with financial advisors, and choose the loan that aligns with your dream home goals.

By comprehensively grasping these financial avenues, you’ll be well-equipped to make strategic decisions that pave the way to the doorstep of your future home.