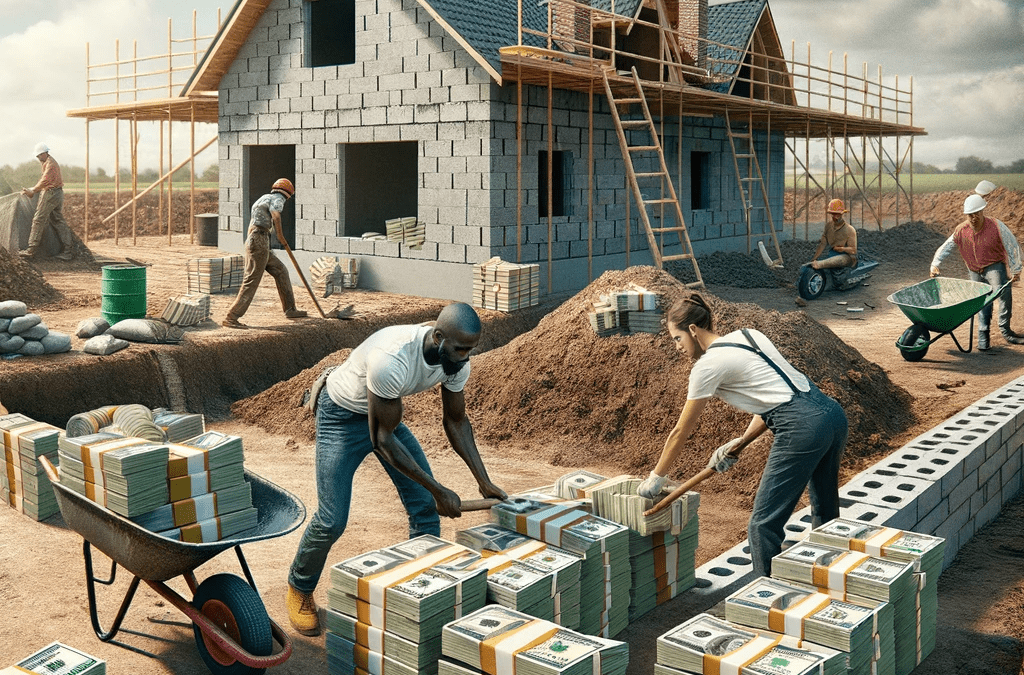

How to get a loan to build a house

The journey to homeownership can take many paths, and for those looking to craft their abode from the ground up, securing a loan to build a house is a crucial first step. This guide will walk you through the comprehensive process of obtaining a construction loan, covering every facet from pre-approval to the final mortgage transition, ensuring you’re well-prepared to take the leap into constructing your dream home.

Preparation: Laying the Groundwork for Your Loan Before you approach lenders, preparation is key. Gather your financial documents, including tax returns, proof of income, debts, and assets. Your credit score will be a cornerstone in determining loan eligibility, so ensure it’s in good shape. If not, take steps to improve it before applying. Additionally, research potential builders and architects, as their credibility will play a significant role in the loan approval process.

Choosing the Right Loan: Navigating Your Options Construction loans are typically short-term loans with higher interest rates that convert to a permanent mortgage once construction is complete. There are a few options to consider:

-

Construction-to-permanent loans:

- These loans convert to a traditional mortgage after the construction phase, saving you the hassle of two separate closings.

-

Construction-only loans:

- If you prefer to have more control over the mortgage aspect post-construction, this loan might be your choice, though it requires two closings.

-

Owner-builder construction loans:

- For those who are also licensed builders, this option allows you to act as your own contractor.

The Application Process:

What Lenders Look For When you apply for a construction loan, lenders will scrutinize your plans. They’ll want to see detailed blueprints, a proposed budget, and a timetable for construction. They’ll assess the feasibility of the project and whether your financial health supports the endeavor. A significant down payment is often required — typically 20% or more.

Understanding the Loan Terms Construction loans are unique, disbursing money in intervals to cover each construction phase. Interest is typically charged only on the funds disbursed, and you may have the option to have interest-only payments during construction. However, terms can vary widely between lenders, so it’s critical to understand the details.

Building a Relationship with Your Builder Your choice of builder will impact not only the final outcome of your home but also the loan process. Lenders often require an approved contractor with a strong track record. Some builders may offer financing options or have preferred lenders they work with, which can streamline the process.

Navigating the Construction Phase As your home takes shape, the lender will issue funds in draws, corresponding with construction milestones. Inspections are common before each draw to ensure the project is progressing as planned. It’s important to manage your budget closely during this phase to prevent cost overruns.

Transitioning to a Permanent Mortgage Once construction is complete, you’ll transition from a construction loan to a permanent mortgage. If you have a construction-to-permanent loan, this transition is relatively seamless. If you have a construction-only loan, you’ll need to apply for a mortgage to pay off the construction debt.

Securing a loan to build a house is a detailed process that requires financial stability, thorough planning, and a bit of patience. With a strong understanding of the various loan types, a solid relationship with your builder, and a keen eye on your finances, you can navigate the loan process successfully and turn your dream home into a reality.